The focus of our Wreckonomics© series, is to examine the sustained and specific appetite for older, high mileage, and negative equity vehicles.

As we close out 2019 and look to the new decade, we wanted to leave you with some current insights into the used car marketplace and specifically the performance and outlook for these low-value vehicles and end of life vehicles (ELV).

U.S. Transportation and Mobility

In spite of alternatives, ride sharing, car sharing, and a younger generation eschewing car ownership, transportation grew again last year. Total Miles Driven grew, extending a 50 year trend.

Vehicles In Operation (VIO)

Though alternative transportation – ride sharing and driverless vehicles soak up headlines, Americans are not ready to end their love affair with cars. Vehicles in operation (VIO) rose to over 278 million units. The Average Age of vehicles continues to grow, now at 11.8 years. And vehicles 16 years and older continue to be the fastest growing segment of VIO.

2019 Auto Salvage Markets

On the salvage and total loss side, 2019 was a topsy-turvy year. Parts demand was steady, there was continued good health in the used car market, record sales at wholesale, and relatively good credit markets, which all pointed to strong residuals and salvage values.

Salvage and Parts Supply

Any perceived gains in driver safety seem to be largely offset by distracted drivers, even more inexorably connected to mobile devices. The issue is not the distracted driving of teenagers, it’s a constant need of attention required by our connected devices and the way they have integrated into our own operating systems. (remember those Tamagotchi Japanese keychain pets kids used to keep years ago, well a modern iphone makes a much more demanding pet). Auto manufacturers, app developers, and even state DMVs are all working to push back on distracted driving but the trends continue.

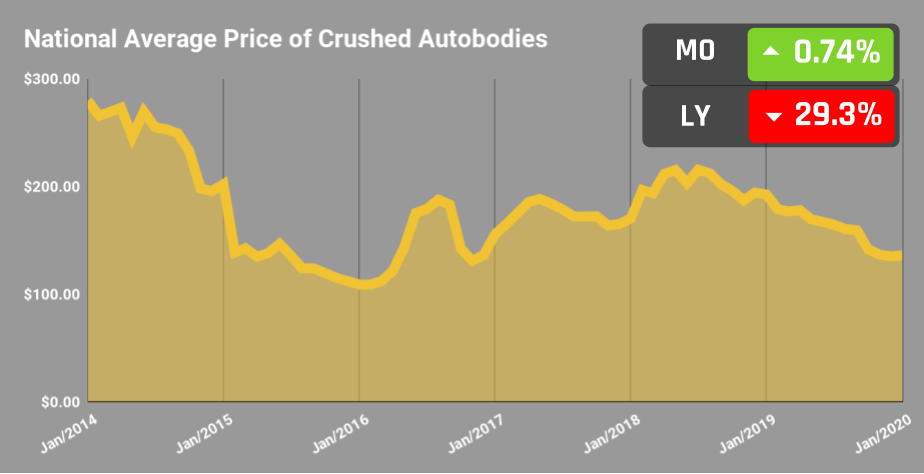

Scrap Markets Plummet

However, at the same time, scrap markets took a big hit due to continued trade interference, slowdown in steel global production, and a lack of spending in domestic manufacturing – lowering scrap values by almost 30%.

So we start off 2020 looking through a pretty grimy lens… rather than a clear outlook.

Here’s where our attention is now.

Good Economic indicators for ELV

Supply

We are at an Apex Age of vehicle operation. The number of cars on US roadways is at record levels. Average vehicle age remains close to 12 model years and the number of Vehicles in Operation (VIO) has never been higher. Miles driven, usage rates, and frequency are all high.

Salvage and total loss markets

Improvement in vehicle safety and crash prevention have not drastically reduced claim frequency or vehicle losses. Additionally, as repair costs rise due to technical improvements in the connected vehicle, the likelihood of a total loss versus a repairable vehicle increases as well.

Environmental Focus:

Our domestic automobile recycling partners have been at the cutting edge of environmental recycling for decades. Now in 2020, the rest of the world seems to finally be paying attention to this success.

Despite recent gains in carbon emissions and greenhouse reduction, the reality is that vehicles on U.S. Roadways haven’t been getting any lighter, they are actually much more densely packed. Also, as manufacturers of modern automobiles have added more material types and electronic components they have become much more complex to recycle. Now more than ever, our partners need to stay current with the latest training and safety guidelines to advance our environmental mission.

Economic Pressures affecting Low Value Vehicles

New Car Sales:

In Automotive, the big headline grabber is always new car sales. While the new car market has never been a perfect prognosticator for salvage value, it’s too big to ignore. A strong top-to-bottom car market is good for business. A weakened new car market is not only rough on retained value models but is bad news for the economy. After years of record unit sales, the last two years have fallen off. As we approach a new decade we may be facing a significant long-term slowdown in demand for new product related to a change in demand.

Scrap:

As mentioned in the opening this has been a roller coaster ride, assumptions about easy fixes or trade deals aren’t likely to play out. We expect even with some type of trade cease fire, the market is going to stay down.

Trade conversations (continued):

This is the most opaque and difficult to predict element of all current economic forecasts. It seems like the twin drivers of low unemployment and strong consumer confidence seems to be the boat that pulls the U.S. economy on water skis. Yet these two forces can’t ignore the other signs of stress. Globally, a world economic slowdown is a growing concern. For most of the last 20 years, the prevailing suspicion was: the world was drafting China’s economic wake and the emerging giant was a good sign of things to come. However, China is now wrestling with their own recession, dwindling job markets, and a serious health threat with the coronavirus. Bad news in China can translate to the rest of the world.

American Election:

Everyone agrees that the economic stakes are very high right now. No candidate wants to have the end of the longest sustained economic growth in American history on their hands. However, the coming election will certainly include lively conversations about trade strategy, borrowing, credit markets, globalization, and military objectives. These conversations in advance of the election will possibly cause some market unrest…. It’s unavoidable and ill timed.

Summary Economic Outlook

At ARS, we look favorably at 2020 and the decade to come when it comes to our primary focus: Low value and end of life vehicles. The high supply and efficiencies in automobile recycling offer many opportunities even in a weakened marketplace. Changing behaviors and appetites are hard to predict but regardless of economic conditions, we expect our partners to be at the forefront of recycling innovation.

About ARS

Advanced Remarketing Services (ARS) works closely with our clients to identify low value vehicles and end of life vehicles (ELV) units in their asset pool. Our focus on older high-mileage and negative equity units helps to reduce fees and deliver the highest possible returns..

If you have a pool of low value vehicles in your portfolio or if you’re looking at ways to maximize recoveries, please reach out to us at ARS. Send us an email: success@arscars.com

STAY IN THE CONVERSATION

Visit ARS Market & Metals blog:

https://www.arscars.com/category/market-metals/

And subscribe for updates!

To address the rising tide of negative equity units, ARS developed the mBid® application to leverage local demand for low value and end of life vehicles from ‘the field.’ Direct sale of these assets lowers processing costs, significantly reduces fee basis, improves cycle time and delivers a significant net lift for our partners.

mBid® is a comprehensive solution, managed completely by ARS. We worked closely with licensed dealers and dismantlers to design a system for distributing and managing these assets that delivers reliable information to buyers, manages logistics, processes titles and is equitable for buyers and sellers.