In previous posts we’ve observed how the vehicle market is much different in 2017 than it was 3 short years ago. Oversupply of new and ‘almost new’ units, maxed out consumer demand and the volume of older vehicles is at historic levels. So what can we do with this information and the bleak prospects that it presents? How do we plan for future success in this new normal? At ARS these question are addressed every day.

At ARS we preach a data led approach to understanding vehicle mix. But before we dive into the data we need to look at our own biases first. Specifically:

- Stop looking globally at recoveries and

- Avoid the temptation of individual recovery stories or singular success.

We need to look at our unit volume as commodities. Our goal is to understand the unique demand appetites for these assets and the forces influencing their demand.

We can’t build actionable intelligence without first breaking down the whole. Looking at the whole asset pool creates a blind to important behaviors. Useful breakdown allows real time decision making and opportunity hunting. It focuses our attention on change and creates predictive tools for maximizing returns.

Predictive Segmentation

“To be useful, segments must be measurable, substantial, accessible and differentiable and accountable.” -Philip Kotler

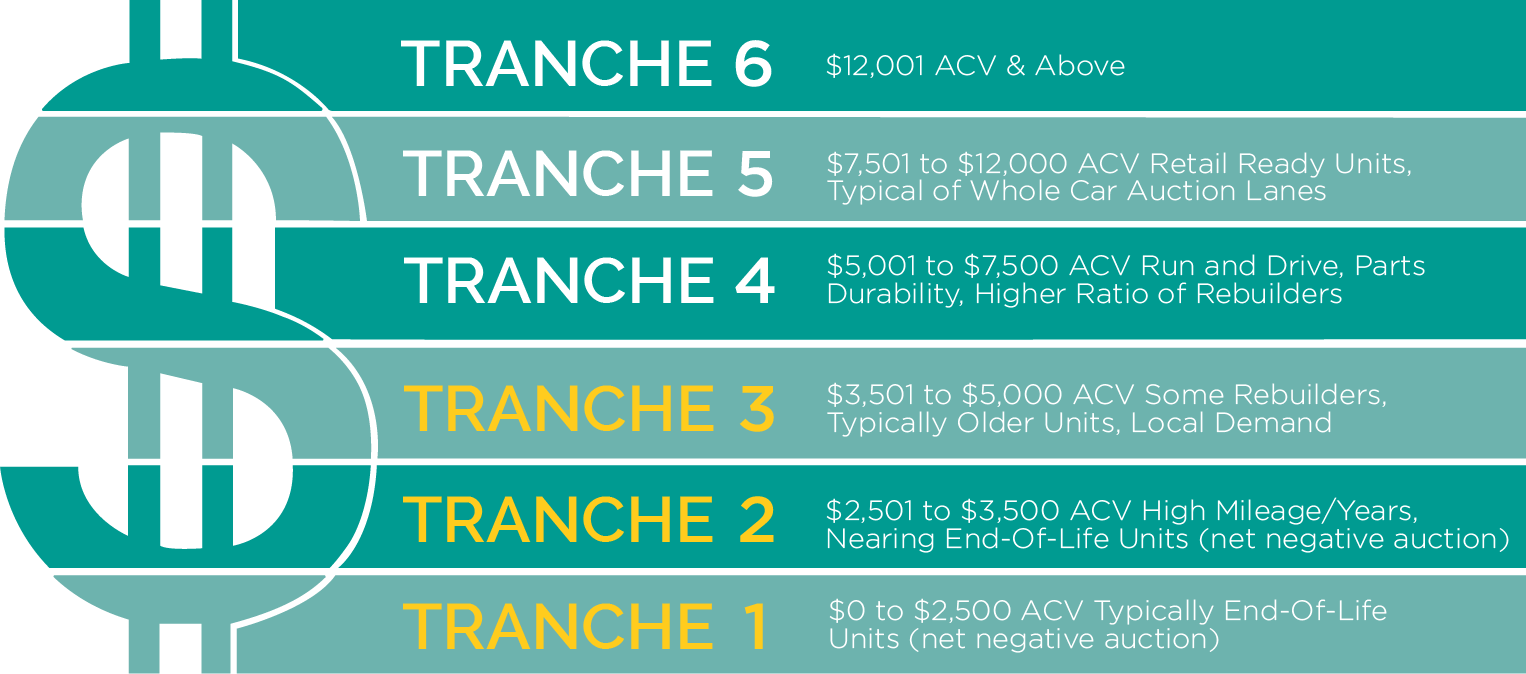

So, how do you usefully break down the whole of your vehicle assets? First, we work to construct a distributed model of volume. The methodology needs to be useful throughout the asset’s portfolio use and depreciation. We rely on a valuation model using ACV values. ACV (Actual Cash Value) is most commonly delivered by consumer price indexes (Kelley Blue Book, NADA, etc), however, these values have inherent weaknesses including a difficulty to see through age and condition of units. Also, in our experience ACV values become increasingly unreliable as the vehicle approaches End of Life. It’s important to note that we’re not using these as dollar valuation tools, instead we’re using the valuation as an index point to create our distributed model.

At ARS we use a method with of our clients of examining vehicle asset values by TRANCHE

TRANCHE: part or a unit of a larger unit or asset pool

Tranching the data allows us to again focus on sales behaviors that influence returns. For example, a typical client portfolio might tranche as below.

Understanding tranche dynamics can immediately save dollars by reducing touch points and transportation costs by recognizing remarketing solutions from the very beginning. Tranche data allows us to focus on specific sales behaviors and requirements and at each tranche. Vehicles in Tranche 1 have different requirements, toolsets and opportunities than Tranche 6. This model creates opportunity for analysis that can see through depreciation and condition to build alternatives that are useful for a variety of strategies.

Tranche analysis is not restricted to the Remarketing exercise. We can use the same segmented view throughout the asset’s use: from acquisition to liquidation, regardless of your industry. This may mean pre-loan, pre- policy, pre-purchase, pre-loss, pre-recovery. Members of your team can observe different behaviors from borrowers, clients or policyholders at each tranche. Strategic management of these assets can influence logistics, estimatics and cycle time.

Remarketing & Full Channel Selling

At ARS the use of tranche data is incredibly helpful in leveraging every opportunity to maximize returns. We are supporters of an agnostic system of selling vehicles throughout the ENTIRE remarketing channel. We call this Full Channel Selling, it is a data led approach to diverting the asset to it’s maximum opportunity. All points of sale are scored on tranche performance. Our scoring allows us to make informed decisions about remarketing vehicles in real time. Depending on the tranche of the vehicle, the set of options is more defined. For example: unit volume in tranche 1 and 2 is often net negative of fees at the auction and are ideal candidates for direct sale using our mBid® Platform. Or volume in tranche 4 needs to be carefully triaged for mileage and condition and the auction point of sale can be selected using our scoring system. If the vehicle is drivable with high mileage one auction might be better selected than the other, the score reflects these opportunities..

We’ll dive deeper into Full Channel Selling and Point of Sale Scoring in future Wreckonomics™ but the opportunity for higher returns and improved cycle times should not be missed.

One of the greatest opportunities of this tranche data is the ability to adjust to market forces. The vehicle market is more volatile than ever, changes in interest rates, effect of hurricanes, create opportunities or hurdles that need to be navigated quickly and seamlessly. Utilizing a tranched model lets you focus on the most important hazard or opportunity.

In our next post we’ll dive deeper into the the application of these models. It’s influence in repossession, remarketing, cycle time, logistics. STAY TUNED

To address the rising tide of negative equity units, ARS developed the mBid® application to leverage local demand for low value and end of life vehicles from ‘the field.’ Direct sale of these assets lowers processing costs, significantly reduces fee basis, improves cycle time and delivers a significant net lift for our partners.

mBid® is a comprehensive solution, managed completely by ARS. We worked closely with licensed dealers and dismantlers to design a system for distributing and managing these assets that delivers reliable information to buyers, manages logistics, processes titles and is equitable for buyers and sellers.

| ARS Helps our clients identify low value and ELV units in their asset pool, focus services for the remarketing or recycling and delivering the highest possible returns..

If you have a pool of low value vehicles in your portfolio or if you’re looking at ways to maximize recoveries, please reach out to us at ARS. Send us an email; success@arscars.com STAY IN THE CONVERSATION Visit ARS Market & Metals blog: https://www.arscars.com/category/market-metals/ And subscribe for updates |