Scrap steel prices rebound to 2018 high after brief decline.

[avatar user=”zlasky” size=”thumbnail” align=”left” /]

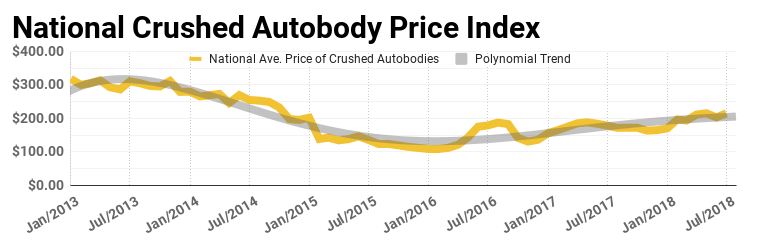

After a brief drop in prices last month, the scrap metal market rebounded to reach its highest point in 2018. The May Advanced Remarketing Services scrap steel report showed that the price per ton of scrap steel had reached its highest point since October 2014. This month the average price per ton of crushed autobodies nationwide is up over 6% – reaching a multi year high. Since the end of 2017, the price of scrap steel has risen about $50 to bring the market price over $215 halfway through 2018. Compared to 12 months ago, scrap prices have now grown by over 20%. What a year 2018 has been!

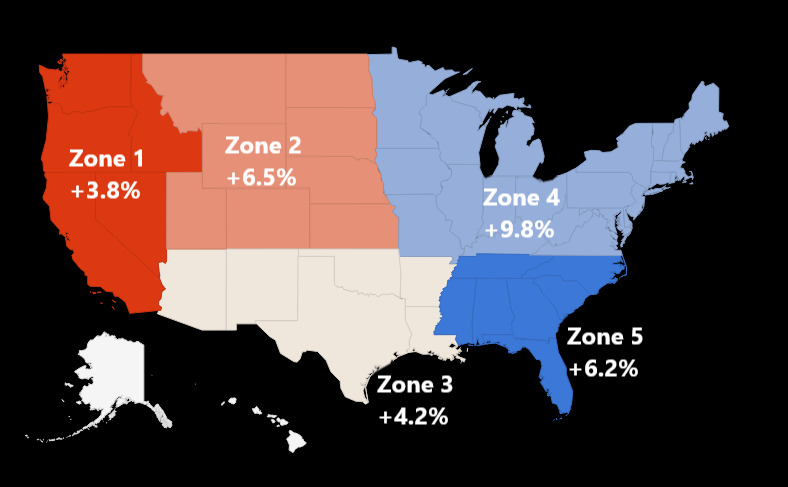

Scrap steel market positive across the country, northeast U.S. shows most growth.

Last month we saw varying declines in scrap prices all across the country. Seeing how we already know those losses have been erased it should be no surprise that positive growth was seen in each zone. Leading the way is Zone 4 (northeast) which grew by nearly 10% followed by Zone 2 (midwest) and Zone 5 (southeast), which both grew over 6%. Overall, it was a good month with a relatively even rise in the price per ton of scrap metal nationwide.

Market News: Tariffs remain hot topic, manufacturers feeling impact and focus turned to automobiles.

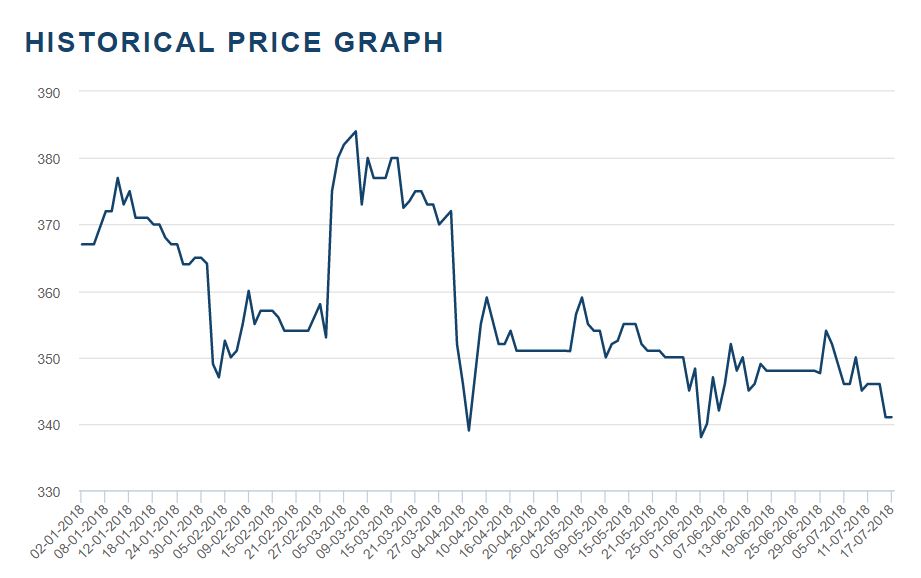

Steel and aluminum tariffs have continued to be a poignant topic of discussion among political pundits. As long as the tariffs are a national focus we will continue to cover them in our Market & Metals blog space. Among all of the back and forth between the United States, China and the other steel producers it has proved to be a bit of a roller coaster ride in the steel and scrap markets. We can see this in the below chart posted on the Steel Scrap Metal Forecast blog on You Call We Haul.

Since the tariffs were instituted and particularly dating back to when the NAFTA and EU exemptions expired, domestic manufacturers have been feeling the impact. From the recent Beige Book report and noted by the Wall Street Journal, one manufacturer says “he could not get the quality of steel needed domestically and anticipated losing business to foreign competitors who are not faced with steel tariffs.” Another manufacturer made a note that the steel tariffs have been chaotic to their supply chain by disrupting orders, increasing prices and causing panic buying.

Next on the horizon are sweeping tariffs on automobile imports. Despite growing resistance from the automobile industry we seem to be pushing closer to implementing new tariffs on a $176 billion dollar industry. We will cover this more closely as decisions are made and relevant information hits the news.

While we expect to see more of a trickle down effect on scrap prices its tough to forecast forward. China has always been the biggest buyer of American scrap but that may not be the case now. Lets hope we continue to have a strong domestic demand for scrap metal because there certainly won’t be a shortage of it on our hands. If you would like to listen to us talk a bit more on the subject and other work we do in the automotive industry you can listen to a radio interview myself and CEO Joe Hearn did on a local station.