First Quarter 2023: Value of Scrap Metal Looking Stagnant

Uncertain markets for uneven times. Tracking some ups and downs for the new year.

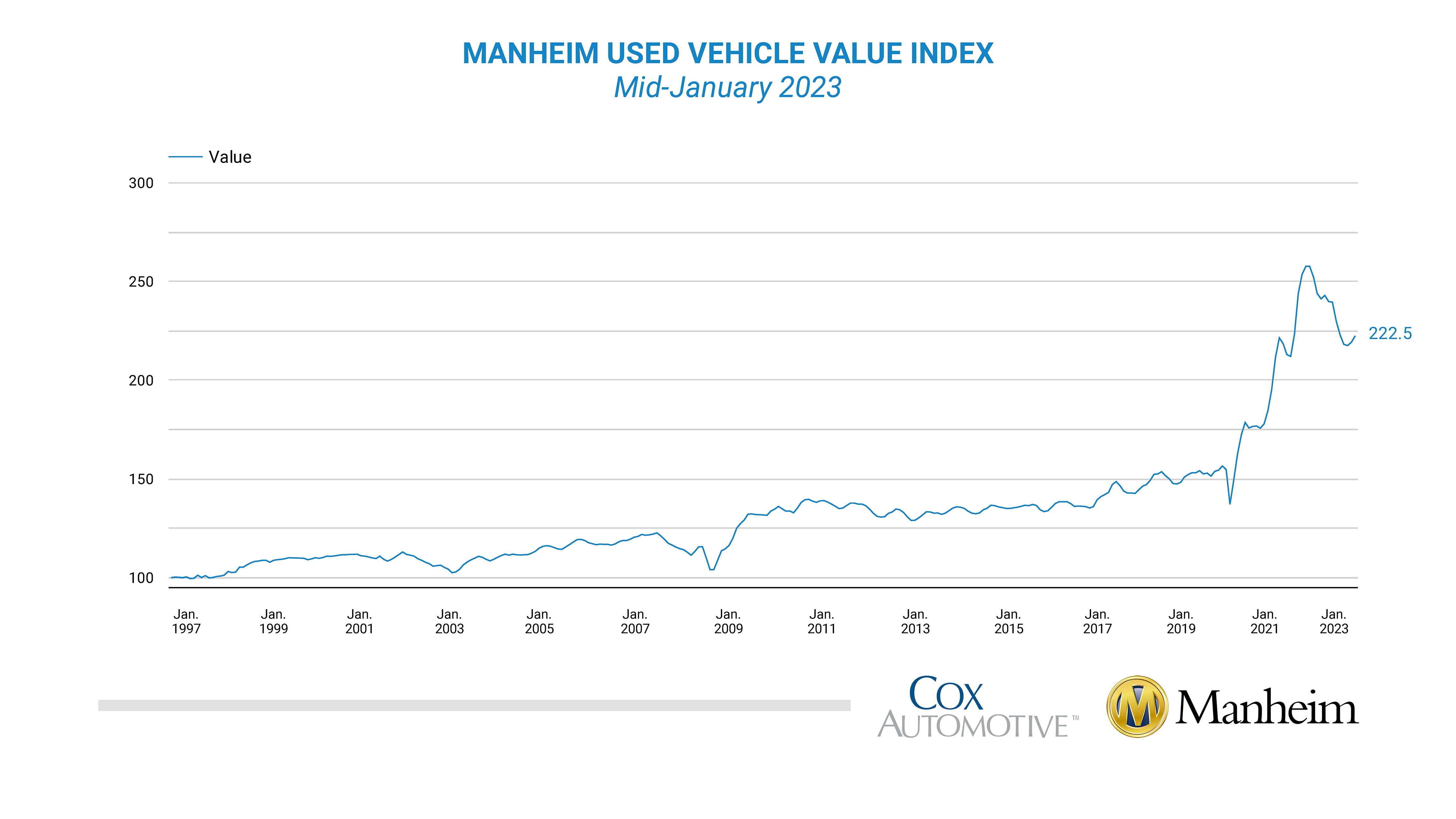

Wholesale Auto Values

As we approach three years of pandemic influenced change, the wholesale market has looks to mirror 2021. The wholesale use-vehicle prices increased 1.5% from December in the first 15 days of January. Some of this change shows balance between new car and used car purcasing (nada.org). Most industry insiders don’t see this increase in value lasting indefinitely but it was a wecome change after months of decilne. See the Manheim index below:

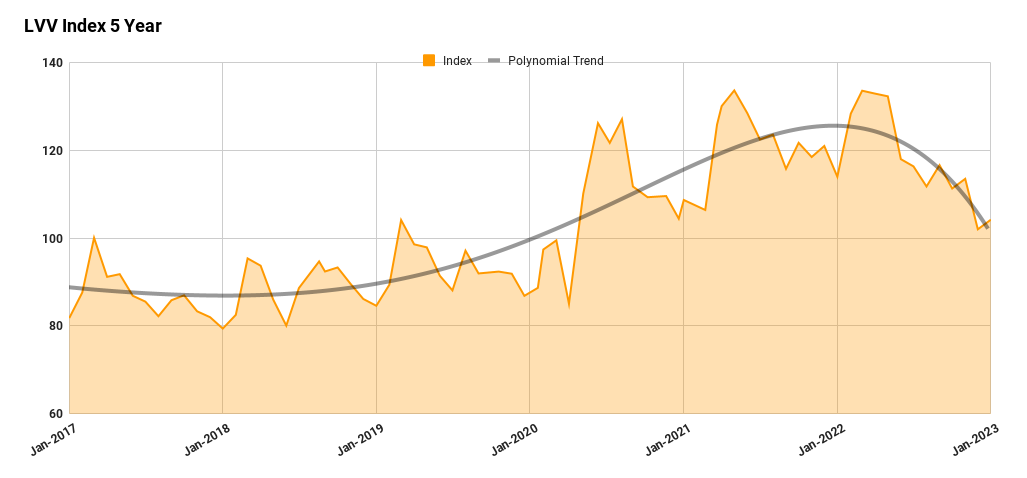

ARS Low Value Vehicle Index

ARS has for many years maintained our own observational price index for vehicles at the lower end of the spectrum. We look at high mileage, high year and end of life vehicles presented at wholesale and monitor the market performance. The data sample that drives our index is from many points of sale throughout the vehicle remarketing industry but the recent fluctuations are telling much the same story we see in Wholesale markets, index data for January show a decrease of approximately 10% year over year but a smaill uptick of 2% month to month.

Source: Advanced Remarketing Services*

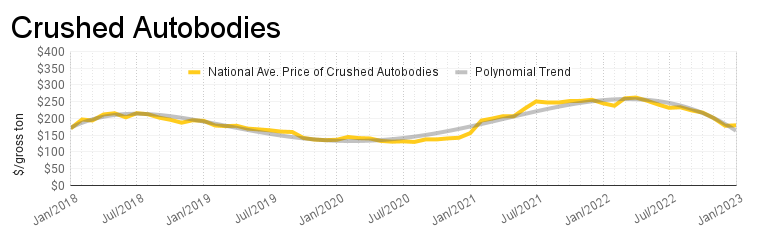

Crushed Auto Bodies

January Crushed Auto bodies were actually up 1% from December 2022 but down 25% from January 2022. Recycled steel prices have also been hit lately and are certainly responsible for some of the decrease in value for ARS’s low value index. Construction costs, labor shortages and improving product supply have combined to lower values on scrap.

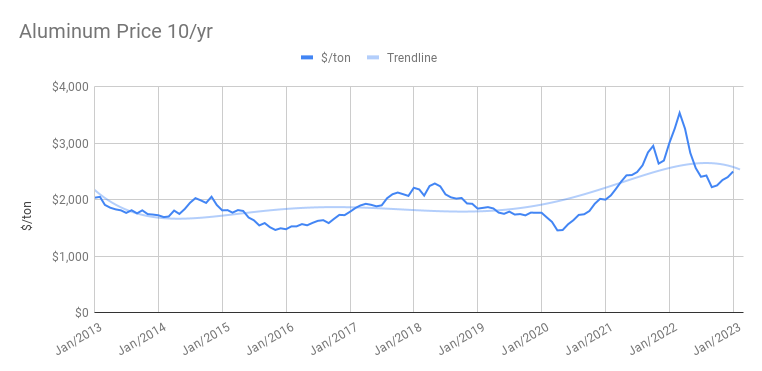

Aluminum

Keeping an eye on Aluminm performance, the tredlines seem to mirror the good news, bad news of other commodities, up 5% for the month but down 17% year over year.

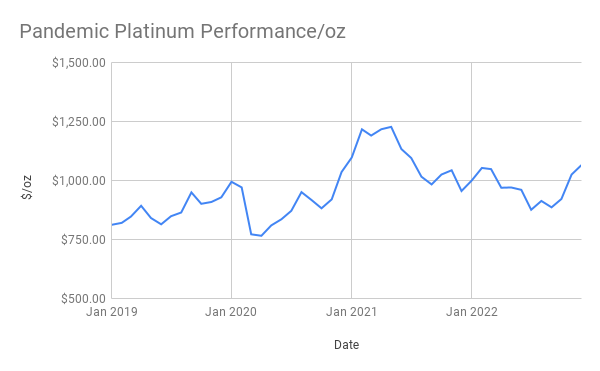

Platinum

The price for platinum has recovered to values similar to the beginning of the year and is on an upward trend.

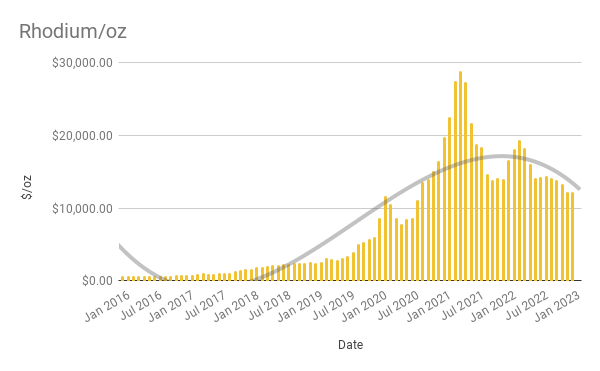

Rhodium

Value of Rhodium has continued its downward trend since the beginning of last year. Down 1% last month but 27% year over year. These prices are comparable to the early days of the pandemic. but still almost three times the value in June of 2019 prior to the pandemic.

H

Fuel Prices

Though technically not a metals value, fuel prices and transportation costs are impacting global demand and use of the still in demand commodities. The news surrounding gas prices is also not particularly good. Gas Buddy predicts a difficult year for fuel.