August 2021

Scrap metals and auto recycling commodities had an interesting month. Contrary to the tentative stability that appeared to be taking hold at the beginning of the summer in the pricing for many of the commodities we look at in the Markets & Metals blog, we’re seeing patterns of both increase and decrease for them currently. This is despite the fact that two of the major influences identified in previous posts, namely the direction US infrastructure legislation is going in, and US-China trade policy, have remained largely status quo.

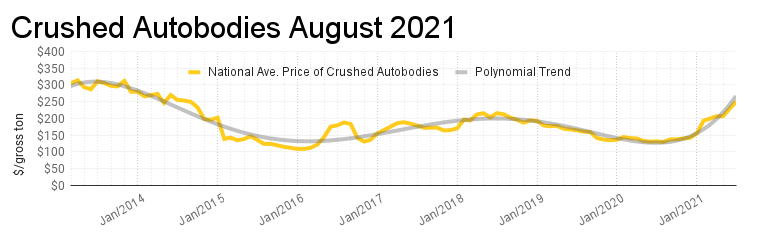

Crushed Auto Bodies:

After the pause in increase in pricing for crushed auto bodies in April to May that we noted in our June post, crushed auto body prices have continued to increase: 11% for June, and another 9% for July. This marks almost a year (since August 2020) where the price of crushed auto bodies has either increased or tied versus the previous month, with a current price 90.5% higher than July of last year.

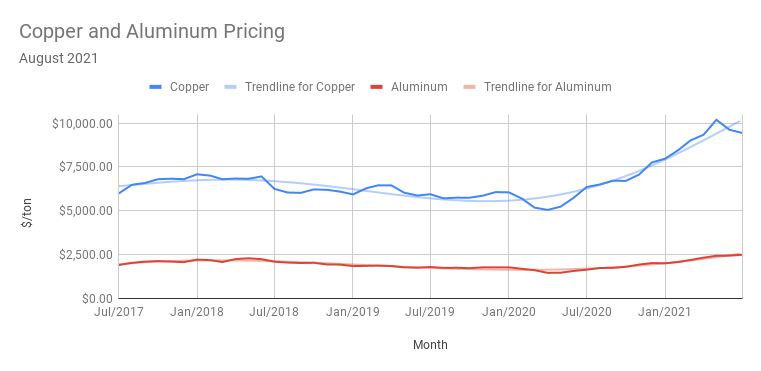

Copper & Aluminum:

Copper and Aluminum are both priced nearly 50% higher than they were this time last year (48.5% and 52%, respectively), but the behavior of their pricing over the last two months has differed. After a 9 percent increase in May, Copper dropped just under 6% for June and another 2% for July. Aluminum is up for the sixth month in a row, 2% from June to July.

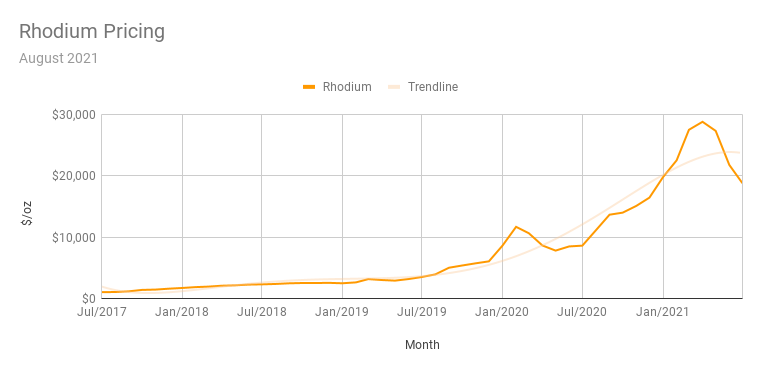

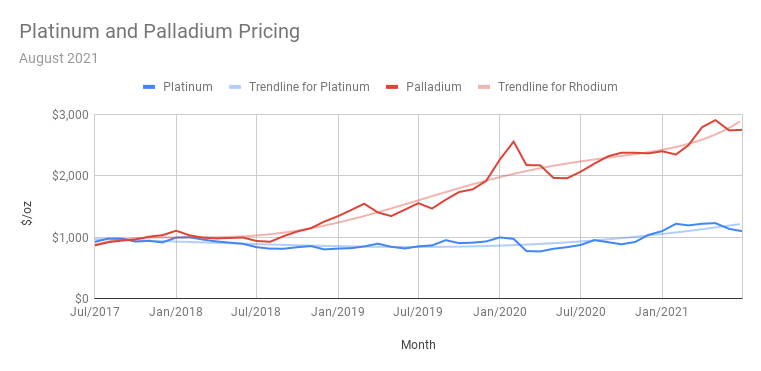

Platinum, Rhodium, & Palladium::

In contrast to the upward trend that we’ve witnessed with these 3 precious metals since late 2020, pricing is cooling off. Platinum is down for the 2nd month in a row, 7 percent for June and another 3 percent for July. After 12 months of monthly increases, the last 3 months saw decreases in the price of Rhodium: 5 percent for May, 20 percent for June (!), and 14 percent for July. Palladium’s price for July was nearly unchanged from June, after an almost 6 percent decrease from May.

The changes in pricing for all of these commodities reinforce the thesis of June’s Markets and Metals post; namely, the tentative and unstable nature of apparent stability when it is observed. This is underscored by the fact two major contributing factors to the pricing of these commodities have remained unchanged.

Despite rhetoric expressed by both countries that would indicate the opposite, US-China trade policy has remained status quo. Another factor, infrastructure investment, also continues to be status quo. Infrastructure investment was known to be a high priority with the incoming Biden administration, and this has continued to move forward, with the Senate passing a $1 trillion infrastructure bill on August 10. The House will vote on this when they get back from their summer break in September.

With the negative outlook in the August 9 report from the UN Intergovernmental Panel on Climate Change about global warming, and UN-lead international climate change talks in 3 months where nations are expected to strengthen their efforts to reduce global warming, it also stands to reason that the factors that led to the increase in pricing for metals essential to much of the technology crucial to accomplishing that goal should continue to be relevant.

Another potential variable that exists is how the Delta and other Covid-19 variants will effect things. While many areas in the US and abroad are considering or have re-introduced mask mandates after loosened restrictions during Spring and early Summer 2021, this does not appear to be having an effect so far on anything that would directly affect commodities pricing that we examine in this blog.

source: Matthey

source: Matthey