[avatar user=”croberts” size=”thumbnail” align=”left” /]

In our last post we started a conversation about vehicle retirement; today I’m weighing in on the conversation as we take a closer look at end of life vehicle (ELV) challenges and solutions.

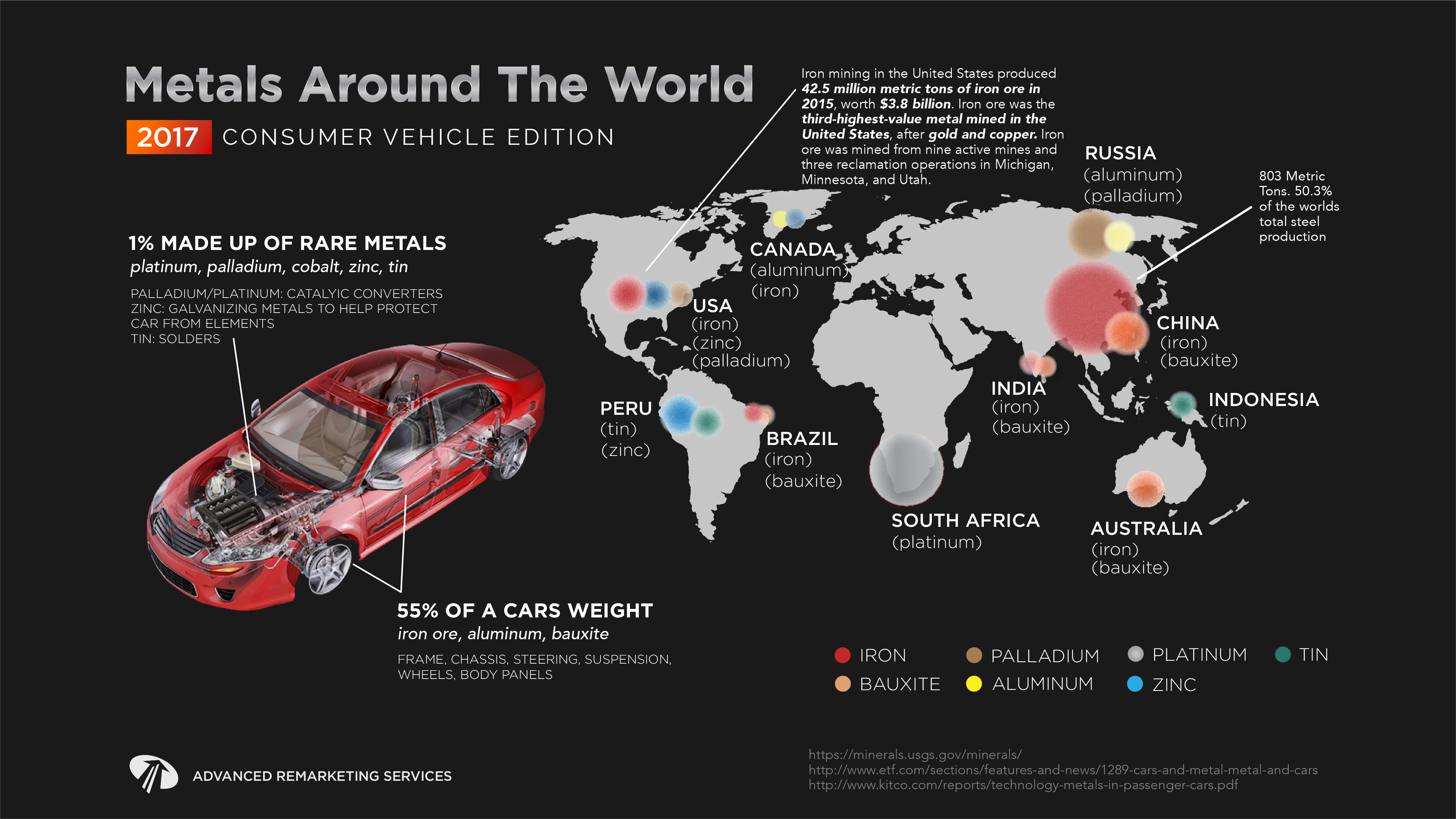

Prior to joining ARS I spent 5 years working in the metal recycling industry. Long before working directly in the industry I’d had a fascination for automobile recycling, shredders and renewable resources. As mentioned in a previous post the automobile is the most heavily recycled consumer product but that is only the tip of the iceberg. Here’s some more facts that might catch your attention.

- Every year, over 25 million tons of materials are recycled from old vehicles.

- The car recycling Industry is the 16th largest in the United States, contributing $25 billion per year to the national GDP. The US automotive recycling industry employs around 100,000 people and earns around $25 billion a year. There are around 7,000 vehicle recycling facilities around the USA.

- However, most auto recyclers are small businesses. More than 75 percent of all automotive recycling companies employ about 10 people.

- Every year, the automobile recycling industry in USA and Canada provides sufficient steel to produce roughly 13 million new vehicles. SOURCE

Working in the field I had a chance to far better understand the intricacies and challenges associated with recycling businesses. The operations are diverse and the market incredibly complex. I learned quite a lot about the men and women who compete in this industry and the myriad of challenges they face.

Just last year, I was seated in a Baltimore conference room at the 2016 Auto Recyclers Association Expo listening to the Keynote economic report given by Joe Pickard of ISRI (Institute of Scrap Recycling Industries). The crowd was filled with generational auto recyclers, small business owners and multinational C.E.O.’s.. These men and women aren’t the ‘junkyard dogs’ that are too often mis-associated with auto recycling. They are very smart and talented competitors that have been participating in global commodity markets for years. The recycled content processed via automobile recyclers is an important contributor to the manufacture of new materials and ‘competes’ with ‘raw material’ (or ore).

Take a look at the infographic below to better understand the world metals market and it’s place in vehicle production.

For everyone at the ARA Conference, 2017 business opportunities were closely tied to the market report. However, this audience knew better than to hope for much of a ‘forecast’. Auto Recyclers now operate in a rapidly changing marketplace that is in a stark contrast to the strong market of the previous ten years. Booming global demand and a Chinese economy in growth mode, teamed with devaluation of the US dollar sent salvage recoveries soaring. But, those days are long gone and unlikely to return. Global economic slowdown has a hold on most markets and foreign currencies struggle to keep pace with the United States. The result is a significantly diminished market.

Take a peek at the values for crushed auto bodies over the last 7 years.

The most recent uptick in scrap demand is incredibly well timed. Five months ago we were facing a 10 year low. As you can see above, values are still down over 30% from 2014 values. This devaluation is of particular concern as wholesale values continue to soften. (More on this in our next post Wreckonomics 1.3 Wholesale Markets) For now, this small relief in form of scrappage values has become a bright spot for many ARS clients. However, with a domestic economy stuck in neutral: What guarantees do we have for the future? How long will the present trends continue?

As we said in our first Wreckonomics post this uncertain market is the NEW NORMAL.

For our clients, to compete in this transformed marketplace, ARS responds with real time data, flexible process and proven solutions. We work to marshall appetites of buyers, provide an easy process for buyers and sellers.

In a diminished sales environment, remarketing and transportation costs erode recoveries as never before. ARS refuses to look at these costs and structures as rigid. We know there are more efficient and equitable ways to tap into ELV appetite. Working on solutions like this is the very reason I joined ARS. We see opportunity where others see only noise and difficulty.

ARS is completely unique in our ability to sell lower valued, end of life vehicles to the right spot in the recycling stream. As part of our Full Channel Remarketing™ strategy, we segment the possible points of sale based on appetite and opportunity. Working directly in the scrap metal recycling industry, I realized that shredding operations were largely considered downstream but actually presented a competitive alternative to purchasing as long as handling and transportation was closely managed.

At ARS we work to find scrap operations that can compete not only in terms of dollars but also serve as a responsible recycling partner. To be able to accomplish that the scrap operation must have transportation solutions able to meet the demands of seller’s service level requirements. They must also perform at least partial dismantling to be able to economically compete for these volumes. We access such appetites locally and deliver the resulting, often pleasantly surprising returns to our clients.

This NEW NORMAL won’t allow you to continue to look at your remarketing returns in the same old manner. Diminishing returns simply demand your attention. If you’re interested in our services or discussing our ideas, you can reach me personally at croberts@arscars.com. If you’re able to share some data with us we might be able to deliver a fresh perspective.

If you have a pool of low value vehicles in your portfolio or if you’re looking at ways to maximize recoveries, please reach out to us at ARS. Send us an email; success@arscars.com

STAY IN THE CONVERSATION

Visit ARS Market & Metals blog:

https://www.arscars.com/category/market-metals/

And subscribe for updates.