Second Quarter 2022: Out-of-market pressures deflate values

Global economic conditions rough up metals markets. U.S. Inflationary pressures are causing uncertainty. Negative outlook for sustained economic growth are slowing, impacting pricing across the board.

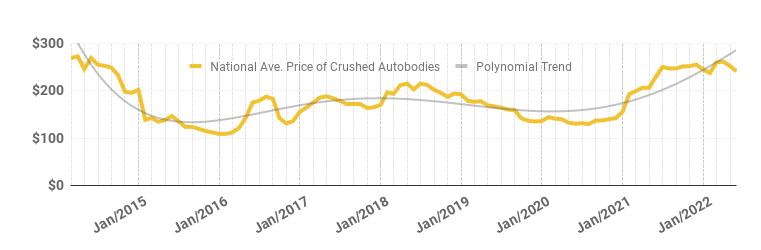

Crushed Auto Bodies

Inflationary pressures have been driving values down but overall demand remains high. Auto recyclers continue to struggle with product availability, keeping prices relatively stable. Steep rise in fuel costs is pushing vehicle ownership. Expense is expected to move fuel inefficient units to recycling stream.

Platinum

The price for platinum softened significantly in Q2 down 8.8% from February ’22 high value and 15% from last June.

Copper

Similarly, copper prices have noticibly slipped, moving down roughly 12% from March 22 highs.

Rhodium

Rhodium continued it’s downward slide in 2022, as prices slipped 35% from the same time last year. Much of this may be attributable to the reduction in use by manufacturing sector. We anticipated this softening in earlier posts:

“Historically, rhodium price increases are related to automotive emissions legislation, but the most extreme peaks in Rhodium prices are the result of supply chain disruptions, of which the pandemic is certainly a most recent example. They’re typically followed by decreases as industry responds to these prices by implementing means of reducing rhodium use.” Wreckonomics June 21.

However, to put this in context, these recent decreases still leave Rhodium at over three and a half times the value in June of 2019 prior to the pandemic.

Fuel Prices

Though technically not a metals value, fuel prices and transportation costs are impacting global demand and use of the still in demand commodities. The rise in fuel prices is responsible for some of the impacts we see in our tracked values by quarter.

Wait & See (continued)

The world economy continues to struggle with inflationary pressures. June’s stock tumble caused a high level of concern among American consumers. Global economic outlooks remain mixed to pessimistic. Commodity forecasts have been similarly affected. Metals markets remain in a wait and see mode for the foreseeable future.